No Risk, No Reward

Quote Review:

-

My review

User Review

( votes)A popular saying, that is simplified to the max. It states that taking risks is essential to reaping rewards. Recently i wrote about a similar quote:

The only strategy that is guaranteed to fail is not taking any risks – Mark Zuckerberg

To quote what i wrote previously:

the quote alone, sums entrepreneurship, business and investing. Entrepreneurship is about taking risks, if your strategy is just keep things as they are, and don’t bother taking risks, then there is a 100% guarantee that nothing will come from this act.

For example: you have 1000$.

If you do not take risks by investing this 1000$ or using it for a business, then you guarantee that you fail at making any money.

If you do take risks by investing or using this 1000$ for a business, you may or may not make money. You might lose the amount partially or totally, but you might as well create a business that generates 10x that amount, or have a return on your investment 5x the amount.

No Risk, No Reward … No Risk, No Gains

This statement and it’s variant are very popular, hence i do believe others might have interesting point of views as well.

Below is some of the most interesting views concerning this topic.

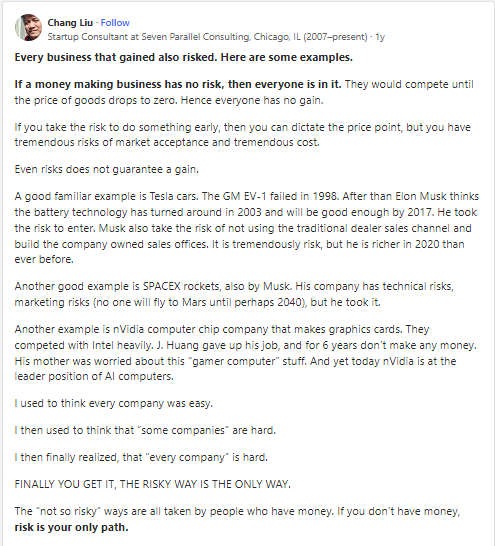

What Chang explained is that taking risks in specific fields and industries will pay off because if successful you can dictate the price-point. This is essentially the first mover advantage. And when you want less risky businesses, you will have to compete, and thus drop the price/ gains / reward.

Michael here went into the theory of Chaos, not related in any way to the No risk No reward statement, but makes him sound smart to the none scientific minds. However i like how he defined risk as relative (:P no pun intended). When he said:

Risk also has a personal perspective. Given the fact that how well we individually know, understand and are prepared for a given situation, that same situation can present risk(s) for one person, and not another.

In fact, we can “tilt” the normally balanced risk/reward equation to our advantage with knowledge, understanding and advanced preparation for what happens or what we’re planning to do.

And he nailed his argument by adding:

If you know your business well, and expect a business risk to occur, its no longer a risk, while if you do something new or different and it generates something you don’t expect, that affect is by definition a risk.

James here is skeptic of the mantra of big risks big rewards, he uses mostly none business related examples to prove his point (a kind of straw man fallacy in my opinion), James end it with this conclusion:

Big risk certainly doesn’t have anything to do with the amount of reward you get unless you can somehow get that spelled out in writing in contract language that guarantees the reward somehow. Generally, if something is too good to be true — it truly is.

Elijah is giving a non entrepreneurial approach, stating that people should seek high reward low risk jobs.